Comprehensive Financial Planning

We understand you’re saving for all different life events: retirement, a house or simply to build wealth.

Wealth Management

Accumulation of wealth is key to working toward your financial goals. Appropriate risk assessed investments, modeling of investment timeframe and professional management is key to having confidence in your investing.

Employee Benefit Solutions

It is our belief that business owners view employee benefits as a faucet on the back of their business that’s running all night long!

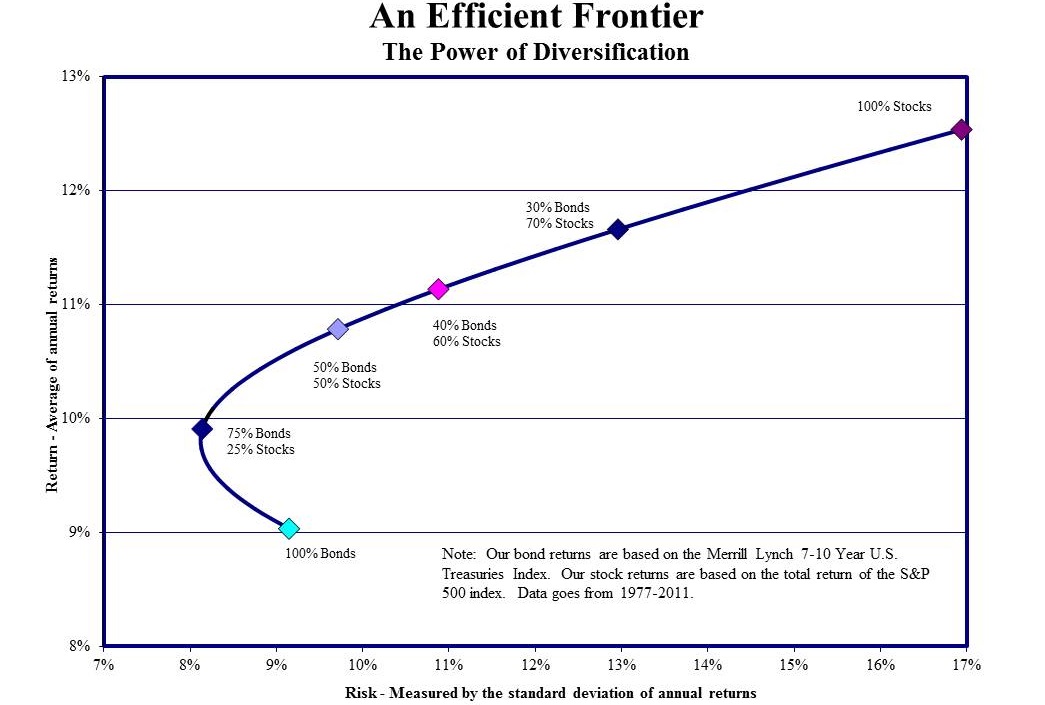

Your Efficient Frontier

Do you know your Efficient Frontier? Are you in a “Comfort Zone” of confidence such that your financial plans can weather unfavorable market conditions?

About Us

We have over 23 years of experience providing financial strategies for both businesses and individuals. Our comprehensive approach to knowing our clients, their goals, and concerns enables us to create financial strategies to help address their needs.

Frequently Asked Questions

What kind of financial strategies can you provide to my business ?

Typically we engage in Employee Benefit Plan creation and support. We also engage in benefit plan audits – specifically from the perspective of cost per benefit. We analyze the current plan structure to verify if they are paying to much for their plans or not enough. We incorporate the needs and expectations of the participants with the objectives of the owners to create a solution that works for both. We deploy industry professionals to assist in this process as needed.

In addition many companies require executive compensation and non-qualified retirement plans that are discriminatory by nature and require skill in their creation and administration. Our team of Strategic Partners are ready and available to handle the needs of such technical plans.

Do you offer individually tailored investment plans?

Yes we do. Our plans are specific to each client’s unique needs. Our careful approach to knowing our clients help to reveal the types of programs that might be most appropriate with their needs. Once we determine the investment objective we deploy any approved products that are positioned for the desired strategy. Service is important to any plan, and we provide a robust platform and customer service guarantee. We provide access to your accounts on a daily basis and meet regularly to ensure we know the changes that life brings and how we need to adapt.

How would I go about planning for my retirement?

Retirement planning is a science. You should look for ways to adopt the fundamentals of retirement planning and then meet with a trusted financial adviser who can guide you through the process and interpret the industry jargon. This can be done on your own, but where most most people fail is execution. They don’t execute! They fail to move forward as they fear the unknown. A trusted financial adviser will help guide you through the unknown and help you make that first big step.